Table of Contents

uMarketplace Vendors Tax Add-on

Configuration

Vendor tax add-on allows you to create tax rules based on combination of product tax class/customer tax class/vendor tax class.

Third rule option basically determine for which vendor tax rule could be applied for which no.

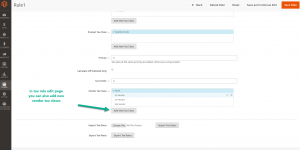

you need to create vendor tax classes same way you create tax classes for products and customers in

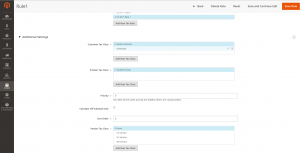

stores > tax rules > Add New Tax Rule (or edit existing one) > Additional Settings > vendor tax classes. then assign tax class for each vendor. you might have as many tax classes as vendor states or countries or any other criteria.

then create tax rules for combination of customer/product/vendor tax classes

and associte respective tax rates.

Examples

you have tax rate for FL you create vendor tax class Florida and select it in

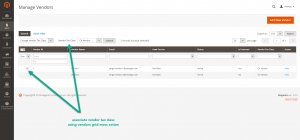

vendor edit > vendor info > Vendor Tax Class

or use massaction in vendors grid

then create tax rule for combination of customer/product tax classes and Florida vendor tax class

and select FL tax rate for that rule.

that rule will have effect only when customer address is FL and vendor tax class Florida

as long as you associted Florida vendor tax class with Florida vendors

it will work when both customer and vendor from florida.

similar fashion configure other tax rules